Difference between revisions of "FinancialCentreFutures:Frankfurt"

Marc morris (Talk | contribs) (Created page with "=Frankfurt - Quick Summary= <center>400px</center> <div class="center" style="width...") |

Marc morris (Talk | contribs) |

||

| Line 3: | Line 3: | ||

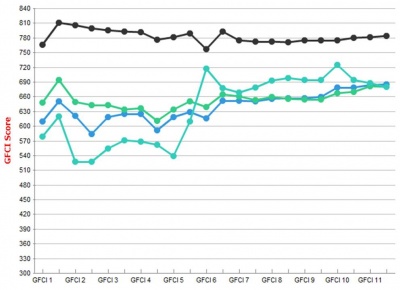

<div class="center" style="width:auto; margin-left:auto; margin-right:auto;"> <small> Frankfurt (Sea-Green), [[FinancialCentreFutures:London|London]] (Black), [[FinancialCentreFutures:Boston|Boston]] (Blue) & [[FinancialCentreFutures:Shanghai|Shanghai]] (Torquoise)</small> </div> | <div class="center" style="width:auto; margin-left:auto; margin-right:auto;"> <small> Frankfurt (Sea-Green), [[FinancialCentreFutures:London|London]] (Black), [[FinancialCentreFutures:Boston|Boston]] (Blue) & [[FinancialCentreFutures:Shanghai|Shanghai]] (Torquoise)</small> </div> | ||

| − | GFCI currently describes Frankfurt as a Global Leader which is both broad and deep. It has a particular strength in the Government/Regulatory sub-indices, as well as strength in Banking and Insurance. Frankfurt performs well with North America and Asia/Pacific respondents, but poorly with those from Latin America or Offshore locations. Since GFCI1 Frankfurt has closed the gap slightly to leaders [[FinancialCentreFutures:London|London]] and [[FinancialCentreFutures:New York|New York]], but has not shown the same level of improvement as some Asian centres (such as [[FinancialCentreFutures:Shanghai|Shanghai]]), which have shown strong gains. In addition, other North American Centres - such as [[FinancialCentreFutures:Boston|Boston]] and [[FinancialCentreFutures:Toronto|Toronto]] - have shown slightly stronger improvements in competitiveness, and have now overtaken Frankfurt in the ratings. Frankfurt has also lost ground to other non-London European centres like [[FinancialCentreFutures:Geneva|Geneva]]. It has suffered reputational damage from the [[Eurozone Crisis]]. | + | [[FinancialCentreFutures:Global Financial Centres Index|GFCI]] currently describes Frankfurt as a Global Leader which is both broad and deep. It has a particular strength in the Government/Regulatory sub-indices, as well as strength in Banking and Insurance. Frankfurt performs well with North America and Asia/Pacific respondents, but poorly with those from Latin America or Offshore locations. Since GFCI1 Frankfurt has closed the gap slightly to leaders [[FinancialCentreFutures:London|London]] and [[FinancialCentreFutures:New York|New York]], but has not shown the same level of improvement as some Asian centres (such as [[FinancialCentreFutures:Shanghai|Shanghai]]), which have shown strong gains. In addition, other North American Centres - such as [[FinancialCentreFutures:Boston|Boston]] and [[FinancialCentreFutures:Toronto|Toronto]] - have shown slightly stronger improvements in competitiveness, and have now overtaken Frankfurt in the ratings. Frankfurt has also lost ground to other non-London European centres like [[FinancialCentreFutures:Geneva|Geneva]]. It has suffered reputational damage from the [[Eurozone Crisis]]. |

Revision as of 16:58, 7 July 2012

Frankfurt - Quick Summary

GFCI currently describes Frankfurt as a Global Leader which is both broad and deep. It has a particular strength in the Government/Regulatory sub-indices, as well as strength in Banking and Insurance. Frankfurt performs well with North America and Asia/Pacific respondents, but poorly with those from Latin America or Offshore locations. Since GFCI1 Frankfurt has closed the gap slightly to leaders London and New York, but has not shown the same level of improvement as some Asian centres (such as Shanghai), which have shown strong gains. In addition, other North American Centres - such as Boston and Toronto - have shown slightly stronger improvements in competitiveness, and have now overtaken Frankfurt in the ratings. Frankfurt has also lost ground to other non-London European centres like Geneva. It has suffered reputational damage from the Eurozone Crisis.