Difference between revisions of "FinancialCentreFutures:Singapore"

Marc morris (Talk | contribs) (Created page with "=Singapore - Quick Summary= <center>400px</center> <div ...") |

Marc morris (Talk | contribs) (→Singapore - Quick Summary) |

||

| Line 1: | Line 1: | ||

=Singapore - Quick Summary= | =Singapore - Quick Summary= | ||

| − | <center>[[ File:SINGAPORE (Blue) - (London (Black), Hong Kong (Darker Blue), Frankfurt (Light Blue) & Seoul (Torquoise)).png|400px]]</ | + | <div class="center" style="width:auto; margin-left:auto; margin-right:auto;">[[ File:SINGAPORE (Blue) - (London (Black), Hong Kong (Darker Blue), Frankfurt (Light Blue) & Seoul (Torquoise)).png|400px]]</div> |

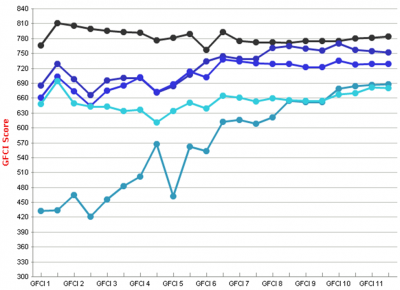

| − | <div class="center" style="width:auto; margin-left:auto; margin-right:auto;"> <small> Singapore (Blue), [[FinancialCentreFutures:London|London]] (Black), [[FinancialCentreFutures:Hong Kong|Hong Kong]] (Darker Blue), [[FinancialCentreFutures:Frankfurt|Frankfurt]] (Darker Blue) & [[FinancialCentreFutures:Seoul|Seoul]](Turquoise). | + | <div class="center" style="width:auto; margin-left:auto; margin-right:auto;"> <small> Singapore (Blue), [[FinancialCentreFutures:London|London]] (Black), [[FinancialCentreFutures:Hong Kong|Hong Kong]] (Darker Blue), [[FinancialCentreFutures:Frankfurt|Frankfurt]] (Darker Blue) & [[FinancialCentreFutures:Seoul|Seoul]] (Turquoise))</small> </div> |

| + | <br> | ||

| + | |||

| + | [[FinancialCentreFutures:Global Financial Centres Index|GFCI]]11 describes Singapore as Globally Diversified centre, which is relatively broad. When respondents were asked in GFCI11 which centres were likely to become more significant, Singapore was ranked first. It has been ranked as a Top 4 financial centre in all of the GFCI issues up to GFCI11. It has particular strength in the Banking, Asset Management, Government & Regulatory and Professional Services, where it ranks fourth. It is also ranked fourth in all of the areas of competitiveness sub-indices. However, although Singapore has closed the gap to the leaders [[FinancialCentreFutures:London|London]] and [[FinancialCentreFutures:New York|New York]], as of GFCI11, it has lost the ground it gained to [[FinancialCentreFutures:Hong Kong|Hong Kong]] in earlier GFCI publications. Its overall progress in the rating’s –up to GFCI11 – has been slightly better than the index as a whole. with [[FinancialCentreFutures:Hong Kong|Hong Kong]] in particular catching up significantly. New York remains the leading centre in North America by some distance, followed by [[FinancialCentreFutures:Chicago|Chicago]] and [[FinancialCentreFutures:Toronto|Toronto]]. Along with [[FinancialCentreFutures:Hong Kong|Hong Kong]], New York and [[FinancialCentreFutures:London|London]] have a large proportion of financial transactions professionals, and although competition between them is strong, their relationship can be seen as mutually supportive with collaboration on regulatory issues. | ||

Revision as of 13:30, 16 July 2012

Singapore - Quick Summary

GFCI11 describes Singapore as Globally Diversified centre, which is relatively broad. When respondents were asked in GFCI11 which centres were likely to become more significant, Singapore was ranked first. It has been ranked as a Top 4 financial centre in all of the GFCI issues up to GFCI11. It has particular strength in the Banking, Asset Management, Government & Regulatory and Professional Services, where it ranks fourth. It is also ranked fourth in all of the areas of competitiveness sub-indices. However, although Singapore has closed the gap to the leaders London and New York, as of GFCI11, it has lost the ground it gained to Hong Kong in earlier GFCI publications. Its overall progress in the rating’s –up to GFCI11 – has been slightly better than the index as a whole. with Hong Kong in particular catching up significantly. New York remains the leading centre in North America by some distance, followed by Chicago and Toronto. Along with Hong Kong, New York and London have a large proportion of financial transactions professionals, and although competition between them is strong, their relationship can be seen as mutually supportive with collaboration on regulatory issues.